VA Cash Out Refinance Loans: A Comprehensive Guide for Veterans

There are instances in life when you may need financial help, whether for making major home improvements, funding your own or your children's education, or even going on that long-awaited dream vacation. If you are an eligible Veteran, active duty Service member, National Guardsman/Reservist, or surviving spouse of an eligible Veteran, you might consider a VA cash out refinance loan.

If you are unsure how VA cash out refinance loans work, this guide is for you. We will answer all your important questions, including:

- What is a VA cash out refinance loan, and how does it work?

- What are the possible uses of the cash out?

- What are the eligibility requirements for applicants?

- How do you calculate your potential cash out and monthly payments?

- What is the appraisal process for a VA cash out refinance loan?

- What are the closing costs and associated fees?

- What does the application process involve?

- What does the application process involve?

What is a Cash Out Refinance Loan?

A cash out refinance loan converts your home's equity into cash out that you can use as needed.

But what is equity? Simply put, home equity is the difference between your home's current market value and the remaining mortgage balance. For instance, if your home's current market value is $300,000 and your mortgage balance is $200,000, your equity is $100,000.

When utilizing a VA cash out refinance loan, you can borrow up to 100% of your home’s value and receive the remaining equity as cash out ($100,000 in our example above).

What is the Difference Between a Cash Out Refinance Loan and a Home Equity Line of Credit (HELOC)?

A cash out refinance loan is sometimes mistaken for a Home Equity Line of Credit (HELOC). However, these two are entirely different loan products.

A HELOC serves as an extra line of credit and uses your home as collateral. It doesn't impact your existing mortgage. This means that a HELOC acts as a secondary loan in addition to your existing mortgage. In contrast, a cash out refinance loan replaces your existing mortgage with a new mortgage.

What Are the Benefits of a VA Cash Out Refinance Loan?

Eligible Veterans, active-duty Service members, National Guardsmen/Reservists, and surviving spouses of eligible Veterans can obtain a cash out refinance loan backed by the Department of Veterans Affairs (VA).

While VA-approved private mortgage lenders offer this loan (not the VA), the VA guarantees a portion of the loan amount to reduce the risk for lenders in case a borrower defaults on the payments.

There are several benefits of a VA cash out refinance loan compared to a conventional or FHA-backed cash out refinance loan:

- Limited closing costs: Despite closing costs being a necessary component of any cash out refinance loan you're considering, the VA has imposed a limit on certain categories of such costs. For instance, lenders are not allowed to levy more than 1% of the loan amount as a loan origination fee. We will discuss what closing costs you need to pay and how much they cost later in this guide.

-

No PMI or MIP: You usually need to pay Private Mortgage Insurance (PMI), which is a monthly insurance payment for a conventional refinance loan, paid if you are financing more than 80% of your home’s value.

For an FHA-backed refinance, you will pay an upfront Mortgage Insurance Premium (MIP) as well as an annual MIP.

For a VA cash out refinance loan, there are no mortgage insurance costs, which can translate into savings over the course of the loan. However, unless you are exempt, you will pay a one-time funding fee, which you should be aware of. We will share more details on how much funding fee you will pay later in this guide.

-

Borrow up to 100% of your home’s value: A VA cash out refinance loan allows you to borrow up to 100% of your home’s value, which means that you might have a higher borrowing power compared to an FHA-backed or conventional cash out refinance loan.

-

No prepayment penalty: There are no penalties if you decide to pay off your loan before the maturity date. FHA loans also carry this benefit. Conventional loans, on the other hand, may have a prepayment penalty, so read the fine print carefully.

These are just some of the benefits of VA cash out refinance loans compared to conventional and FHA-backed loans.

FHA loans and conventional loans can both be viable options depending on your personal financial situation and goals.

What Can You Use the Cash Out For?

The funds you receive through a refinance with a VA cash out refinance loan can be used for various purposes depending on your immediate needs, emergencies, or financial objectives.

1. Consolidate Debts

One of the common uses of the cash out is to consolidate high-interest-rate debts. If you're dealing with mounting debt from credit cards, auto loans, or personal loans, these can be bundled into a single loan through the VA cash out refinance loan. This could result in a potentially lower overall monthly payment, which can ease your financial burden.

However, it's important to note that while this strategy can simplify your debt management by combining multiple payments into one, it might extend the repayment time, and total finance charges could be higher over the life of the loan.

On average, NewDay USA customers reduce their monthly payments by $459 after consolidating debts into a VA cash out refinance loan. That amounts to annual savings of $5,508. Imagine the possibilities with an additional several hundred dollars in your monthly budget!

2. Home Improvements

Maybe you've been dreaming of a kitchen renovation to bring it up to date or installing energy-efficient windows for long-term savings. You might want to enhance your outdoor living space with a deck or a pool or perhaps transform your basement into a cozy family room or a functional home office.

3. Emergency or Retirement Fund

Having a dedicated emergency fund can help you navigate through unforeseen circumstances, such as medical expenses or unexpected vehicle repairs. You can use the funds you receive from a cash out refinance loan to build a cash reserve for emergencies.

Similarly, you can utilize these funds to contribute to your retirement savings. In both scenarios, the VA cash out refinance loan may provide you with an additional layer of financial protection.

4. Education Funding

Whether it's facilitating your child's college education or financing your return to school to learn new skills, this loan can support these educational aspirations. The cash out proceeds this loan offers can pave the way for academic success and career advancement for you and your family.

What Are the Eligibility Requirements for a VA Cash Out Refinance Loan?

To qualify for a VA cash out refinance loan, you need to meet certain eligibility criteria set by the VA and the lender you choose.

We have already mentioned that the VA does not directly provide these loans; rather, they guarantee a portion of the loan, which is offered by private mortgage lenders. Since lenders provide these loans, they often set their own eligibility criteria.

VA Eligibility Criteria

The first step when you initiate the application process for a VA loan, including the VA cash out refinance loan, is to secure your VA Certificate of Eligibility (COE). The COE issued by the VA serves as proof of your eligibility for a VA loan.

Other eligibility requirements set by the VA for cash out refinance loans include those related to property ownership and primary residence:

Service Type and Minimum Service Requirement

Eligibility largely depends on the type and duration of service, which vary depending on whether service was during wartime or peacetime. There are also different requirements for time served as an active duty Service member or as part of the Reserves or National Guard. It's important to confirm that you meet these minimum service requirements, as stipulated by the VA, to qualify for this loan.

Proof of Property Ownership

When applying for a VA cash out refinance loan, the lender will verify your ownership of the property to be refinanced by obtaining the title work.

Primary Residence

The VA cash out refinance loan can only refinance your primary residence. Borrowers are not permitted to refinance investment properties or second homes using the VA cash out program.

Lender Eligibility Criteria

Qualification requirements for a cash out refinance loan can differ among lenders, so you should consult with the lender you are working with about their specific requirements. Here are some common qualification requirements for many lenders:

Minimum Credit Score

Though the VA does not set a minimum credit score for these loans, your lender might. As a result, credit score criteria set by the lender may apply to both home purchase loans and cash out refinance loans.

Debt-to-Income Ratio

Your Debt-to-Income ratio (DTI), which compares your monthly debt obligations to your pre-tax gross monthly income, is an important part of your financial profile that lenders take into consideration when evaluating your loan application.

A lower DTI indicates a favorable balance between debt and income, reflecting your ability to handle loan repayments.

Loan-to-Value Ratio

The Loan-to-Value (LTV) ratio, which compares the amount of your mortgage loan to the appraised value of your property, demonstrates the portion of the property's total value being financed through the loan. For example, if your current mortgage balance is $150,000 and your home is worth $300,000, then your loan-to-value ratio is 50%. (That is, $150,000 ÷ $300,000 = 0.50 or 50%.)

This ratio matters because lenders typically do not lend more than the appraised value of the home to limit their risk. However, LTV ratio requirements can vary among lenders.

How to Estimate Your Potential Cash Out from VA Cash Out Refinance?

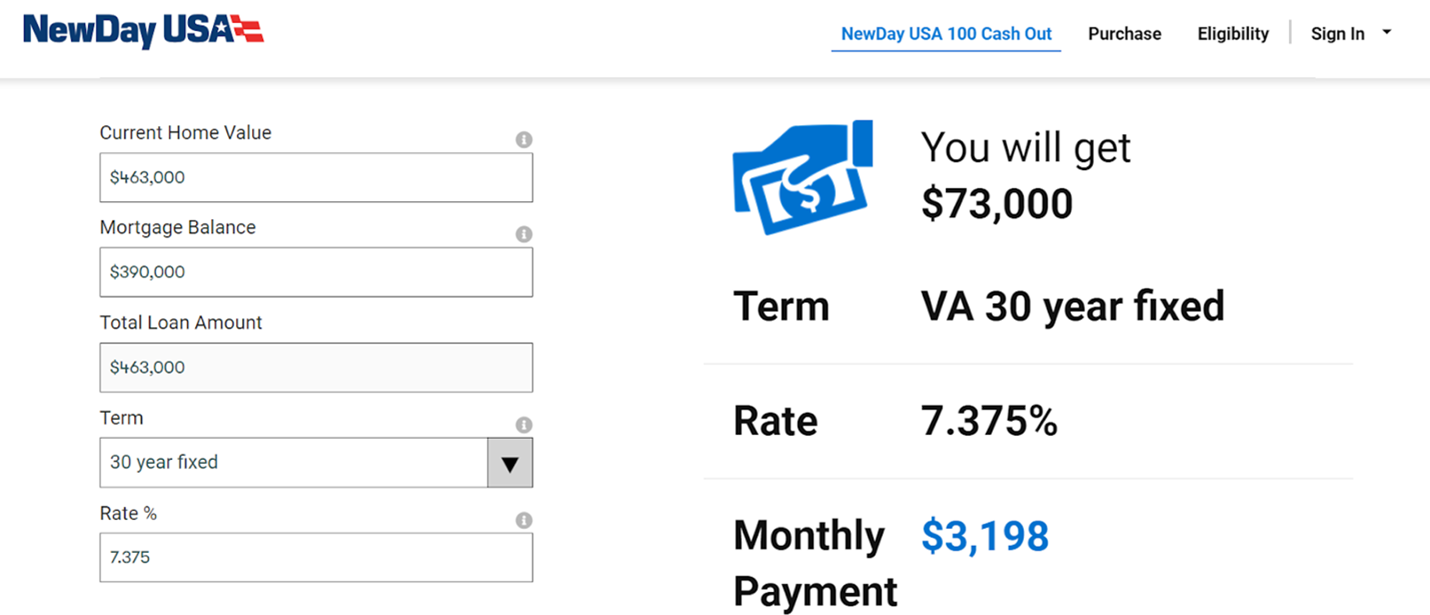

The NewDay USA VA Cash Out Refinance Calculator is a helpful online resource for estimating potential cash out and monthly payments based on some basic information.

Here are step-by-step instructions on how to use the calculator:

- Input Home Value: First, enter the current market value of your home. However, remember that the value you estimate may differ from the value determined by a professional appraiser.

- Mortgage Balance: Next, input the outstanding mortgage balance. This is the amount you still owe on your home. You can easily find this information in your monthly loan statements.

- Total Loan Amount: The calculator assumes 100% loan-to-value (LTV) financing, which is something available to qualified borrowers as part of the VA loan benefit. You won’t need to change anything here. Just note that 100% LTV financing is assumed.

- Term: Select the loan term you're interested in. You can select either a 30-year or a 15-year fixed-rate mortgage term.

- Interest Rate: Enter the anticipated interest rate for the refinance.

After clicking “calculate”, the tool will generate an estimated cash out amount from the refinance, along with a projection of your new monthly payment. Note that the monthly payment only includes principal and interest and should not be treated as an offer to lend. Tax, insurance, and other fees will apply.

The calculator should only be utilized as a guide to help you explore your potential options. These numbers are only estimates, and actual amounts may vary depending on several factors, including the appraised home value and current interest rates. For an actual quote, contact NewDay USA at 844-934-2579.

What Is the Appraisal Process and Cost for a VA Cash Out Refinance Loan?

One essential step to take when considering a VA cash out refinance loan is getting a new appraisal of your home. This is necessary because the home's current value helps determine the loan amount you're eligible for.

The appraisal for a VA cash out refinance loan must be conducted by a VA-approved appraiser. Your lender will order the appraisal while underwriting your loan. The appraisal report prepared by the appraiser is reviewed by a Staff Appraisal Reviewer (SAR), who will then issue a Notice of Value (NOV).

A single-family home VA appraisal can range from $525-$1300 depending on where your property is located, according to the VA Appraisal Fee Schedules.

At NewDay USA, we offer you the option to finance the cost of the VA appraisal along with a termite inspection and water test, into your total loan amount and pay them down gradually during the life of the loan. This way, you don't need to pay for these services upfront.

This arrangement is designed to make the loan process as manageable as possible. However, keep in mind that charges apply if the appraisal is transferred to another lender.

What Are the Closing Costs and Fees?

There's a lot to consider when closing on a VA cash out refinance loan, including various costs and fees. Understanding these expenses upfront can help you better navigate your loan process. Here are some of the closing costs and fees associated with a VA cash out refinance loan, but other fees will apply such as credit report, title fees, prepaids and escrows, etc.

Loan Origination Fee

This fee covers the lender's costs in processing the loan. The VA doesn’t allow lenders to charge more than 1% of the loan amount as the origination fee.

VA Funding Fee

This fee is unique to VA loans, and the percentage depends on whether it's your first time using your VA loan benefit or not. For first-time users, the VA funding fee for a cash out refinance loan is 2.15% of the total loan amount. For subsequent users, this fee increases to 3.3% of the total loan amount.

The funding fee for home purchase loans is slightly different. It depends on your down payment amount as well as how many times you've used your VA loan benefit. If it's your first time, the funding fee ranges from 1.25% to 2.15%. For all subsequent use, the funding fee varies between 1.25% and 3.3%.

Some borrowers are exempt from the funding fee or eligible for a refund.

Other Costs

In addition to these costs, there are specific fees associated with certain inspections. For instance, the average termite inspection cost for loans funded by NewDay USA in 2022, where such an inspection was required, was $121.60. If your home requires a water test, the average cost in 2022, for loans that required one, was $146.85.

How Do I Obtain a VA Cash Out Refinance Loan with NewDay USA?

At NewDay USA our main focus is on VA loans, and we make the process of obtaining a VA cash out refinance loan straightforward and hassle-free.

When navigating through the loan process, borrowers work with dedicated NewDay USA Account Executives, who are responsible for guiding customers through the entire mortgage cycle and delivering a top-tier customer experience. They serve as the first point of contact for Veterans seeking to utilize their VA loan benefit, whether it's purchasing a new home or obtaining a cash out refinance loan.

With NewDay USA, the entire process is as easy as 1–2–3. You can start by calling a loan specialist at 844-934-2579. They are trained to guide you through the application process and can help you obtain a COE to determine whether you are eligible for a VA loan.

1. Submit Necessary Documentation

Provide the required documentation, which typically includes mortgage records, income documentation, and eligibility documents. The specifics may vary, so ensure you understand exactly what is needed during your discussion with the loan specialist.

2. Processing and Underwriting

Once your documents are submitted, we will begin processing your loan, subject to your eligibility. The processing of your loan involves verifying your information. After successful verification, your loan can be approved, and a closing date will be set.

3. Close the Loan

After approval, NewDay USA will send a closing agent to you. This agent will assist you in finalizing your loan. This is the step where you'll sign all necessary documents, verify the terms and conditions, and complete the transaction.

By working closely with our experienced Account Executives, our borrowers can seamlessly navigate through the loan process.

Get Started with Your VA Cash Out Refinance Loan

We hope this detailed VA cash out refinance guide provides you with everything you need to make an informed decision.

If you are interested in determining your eligibility for a VA cash out refinance loan and the potential amount you could qualify for, reach out to NewDay USA. You can contact us at 844-934-2579 or inquire online. Our experienced team will guide you through each step of the process.

NewDay USA-NMLS#1043